Driven by higher volumes in North America and despite challenges with higher freight and raw materials costs, sales for construction and agricultural manufacturer CNH Industrial increased year-over-year in Q3 by 23.9% to $5.9 billion.

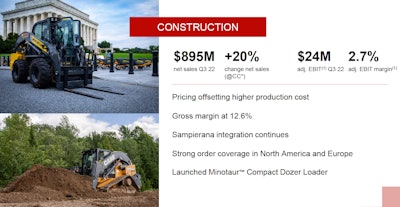

CEO Scott Wine said the company’s construction division saw a Q3 increase of 16% to $895 million.

"The growth that they're seeing in the North American market, and especially in South America, right now is impressive,” Wine said, noting that the company’s construction division delivered $24 million in earnings before interest and taxes at a 2.7% margin.

The company’s portfolio of construction equipment is sold under three brands: Case Construction Equipment, New Holland Construction, and most recently, Eurocomach, part of the portfolio acquired with Sampierana.

"In the third quarter, we started selling Sampierana mini excavators in Europe under the Case and New Holland brands and we opened a new assembly line to increase capacity for those products," Wine said. "With this greater throughput, we will begin exporting those products to other regions in 2023."

Also, Case launched the Minotaur DL550, a new equipment category compact dozer-loader in late August, and the initial indication is that interest is high.

Wine said global industry volume for construction equipment decreased in both heavy and light sub-segments, with heavy down 3% and light down 4%, mostly driven by a 9% decrease in light and heavy equipment demand for Asia Pacific, particularly in China. Demand decreased by 1% in North America, 5% in EMEA, and increased by 21% in South America.

"While we are finally seeing some modest improvement in our supply chain, it is our team's deft execution that enabled these results in the face of unrelenting inflation and volatile currencies," Wine said. "We are not immune from the external impact of geopolitical risks, inflation, supply chain constraints and economic downturns, but we are confident in our ability to continue to minimize these disruptions, maintain our momentum and deliver for our customers."

The CEO only made a brief reference to any challenges the company is facing related to the ongoing strike at two of the company's plants. Nearly 1,000 workers at plants in Racine, Wisconsin, and Burlington, Iowa, have been on strike since May 2, two days after the union's contract with the construction and agricultural machinery manufacturer expired.

Now in its seventh month, there is no clear end in sight for the strike, as both the union and CNH appear firmly entrenched in their positions. CNH reportedly presented what it termed as its final offer in late September, however, no vote has been taken by the union since the strike vote.

“Our goal has always been to get our employees back to work with a contract that is fair and sustainable,” Wine said. “We have been working diligently but so far and unsuccessfully to make that happen.”

He said the company continues to seek resolution while executing a contingency plan to remain operational and work toward meeting customer commitments. In addition, he noted that all costs associated with the strike and future wage hikes are factored into future goals.

CNH Industrial

CNH Industrial

“They're (CNH construction division) looking at what happens when this really strong growth model slows down, and they're trying to build the system so that we stay positive even in those down markets,” the CEO said. “Fortunately, we've got a little bit of time, but they're investing in the portfolio. The product lineup is improving. The technology insertion is improving, and we’re running our plants more efficiently.”

Wine said CNH did decide to transition some products to other plants, which impacted the ability to deliver.

"So obviously, it (margin) was down a bit because we decided to transition production during the quarter," he said noting that the company is not satisfied with the current margins but sees improvement over the next several quarters.

“They've done a lot of cleaning up over the last few years, and I think we will benefit from that going forward,” Wine said.

Construction division order books continued to build up more than 20% year-over-year in both heavy and light equipment, with increases in all regions. In addition, the CEO noted that order books are open through the second quarter of 2023 in most markets with robust order coverage, especially in North and South America.

“We will continue to invest in our future both by expanding, augmenting … and boldly creating the next generation of agriculture and construction products,” Wine said. “We will maintain a watchful eye for signs of recession and will be prepared to adjust our operations as needed. We expect to again contend with supply chain disruptions but see them progressively improving, and we think channel inventories will stay tight for most of the year.”