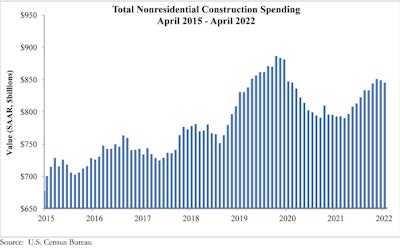

Spending on nonresidential construction projects declined for the second month in a row in April as contractors cope with an all-time high for job openings, according to analysis of federal data by both the Associated General Contractors of America and Associated Builders and Contractors.

“Nonresidential construction spending is being held back by a paucity of qualified workers, not a lack of projects,” said Ken Simonson, AGC’s chief economist. “With job openings at an all-time high and the industry’s unemployment rate at the lowest ever for April, finding workers is contractors’ top concern.”

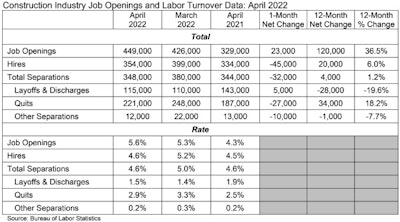

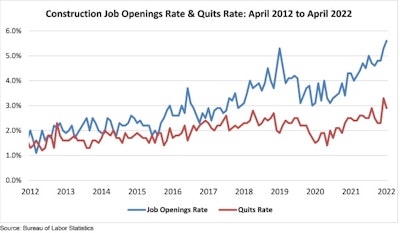

Job openings in the construction industry at the end of April exceeded 475,000, nearly a 40 percent increase from April 2021 and the highest total for any month in the series, dating back to December 2000, according to AGC.

Simonson said a major reason unfilled positions were at an all-time high was that the unemployment rate for jobseekers with construction experience set a record low for April of 4.6 percent.

As an indication of a marketplace that still favors employees as opposed to employers, construction workers quit their jobs at a faster rate than they were laid off or discharged in April. The quit rate of 2.9% was meaningfully above the layoff/discharge rate of 1.5%. April represented the 14th consecutive month during which quits outpaced or equaled layoffs and discharges.

According to both associations, workforce shortages are now so severe they are undermining construction activity in 2022.

“The report also suggests that wage pressures will continue to help stoke economywide inflation,” said ABC Chief Economist Anirban Basu. “That increases the chances that the Federal Reserve will continue to pursue a path of tightening monetary policy. Accordingly, contractors will face both rising delivery costs and cost of capital.”

“The desperate search for skilled construction workers persists,” Basu said. “The number of available, unfilled construction jobs continues to expand. Remarkably, this is occurring despite a lack of strong construction spending growth, which suggests that construction productivity is not expanding. What is expanding is compensation costs, as employers compete aggressively with one another to secure sufficient levels of human capital.”

All in

The downturn in nonresidential construction spending has been widespread. According to the associations, the largest segment, power – comprising electric, oil and gas projects – slipped 1.5 percent in April. Highway and street construction edged down 0.2 percent. Spending on commercial construction – warehouse, retail and farm projects – and on education structures each declined 0.4 percent. Among the five largest segments, only manufacturing construction increased, by 1.7 percent, propelled by a variety of factory projects.

“Despite upbeat contractor sentiment, nonresidential construction spending has been sliding during recent months,” said Basu. “The situation is even worse given that construction spending is measured in nominal terms, and therefore does not account for rapidly rising materials prices and compensation costs, which have put downward pressure on profit margins.”

Despite the overall decline in spending, there are reasons for contractors to remain upbeat.

“A number of segments hammered by the pandemic showed signs of life in April, with spending in both the lodging and amusement/recreation categories increasing on a monthly basis,” Basu said. “Construction related to manufacturing also continues to rise as suppliers desperately strive to keep up with demand and reshoring momentum persists.”