Prices for numerous construction materials are still rising in conjunction with the response from governments and manufacturers to the war in Ukraine. Stainless steel, aluminum coil, aluminum accessories, PVC and other materials are seeing rising prices and extended lead times due to lack of inventory.

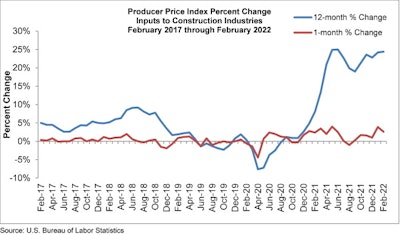

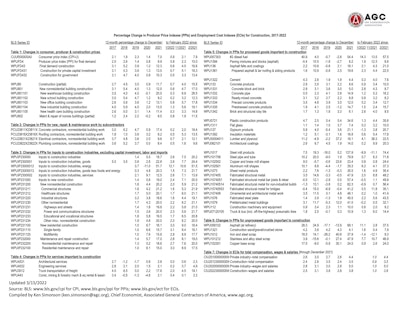

Both the Associated General Contractors of America and Associated Builders and Contractors reported double-digit price increases across multiple categories of the latest nonresidential producer price index.

ABC said last week construction input prices are up 24.4% from a year ago, while nonresidential construction input prices are up 25.1%.

AGC analysis of government data shows prices of construction materials used in new nonresidential construction jumped more than 21% from February 2021 to February 2022. The association noted that more recent price announcements after the February data were collected suggest contractors are experiencing even worse cost pressures this spring.

“Even though the February numbers represent some of the highest year-over-year price increases ever recorded, they have already been surpassed by even steeper price hikes since the war in Ukraine broke out,” said Ken Simonson, AGC’s chief economist. “Since the time these prices were collected, multiple increases have taken effect for metals, fuel and trucking, while supply chains have become even more snarled.”

{Related Content: Video: How Will the War in Ukraine Affect Contractors in 2022?}

Officials from both organizations said rising materials prices and the tight labor market are forcing contractors to charge more to build projects. They warned, however, that further price increases could undermine demand for some construction projects, threatening the sector’s recovery.

Associated Builders and Contractors

Associated Builders and Contractors

“It will get worse before it gets better,” said ABC Chief Economist Anirban Basu. “Not only has Russia’s assault on democratic Ukraine created supply challenges in several categories, including oil and natural gas, but the re-emergence of Covid-19 in parts of Asia and Europe is also poised to produce additional impacts. While many still expect commodity prices to decline later this year, the wait has been meaningfully extended by geopolitical conflicts and ongoing Covid-19 lockdowns.

He noted that the current scenario has the potential to put even more downward pressure on profit margins.

“It is likely that, as bid prices continue to soar, more project owners will choose to delay project starts,” Basu said. “The current state of affairs also creates complications for public agencies considering when to start large-scale infrastructure projects. It is a challenging time to begin such projects, given the workforce shortages that remain and materials price inflation.”

Some public administrators will decide to extend planning time, delaying project start dates, he said. To date, though, many projects that were scheduled have continued to move forward.

“Construction backlog, as measured by ABC’s Construction Backlog Indicator, has remained stable for several months in the wake of rapidly rising materials prices,” Basu said. “It remains to be seen whether this stability can prove resilient in the face of additional, severe supply challenges. Backlog would likely be rising rapidly if costs were more stable. Nonetheless, construction confidence indicators continue to improve. Collectively, contractors expect sales and employment to expand over the next six months. But what is far more remarkable is the expectation that profit margins will expand, indicating that demand for construction services remains elevated enough to countervail cost increases as we head into the heart of 2022.”

AGC

AGC