The Komatsu PC138USLC-11 was a top new excavator model financed in the first quarter of 2018.

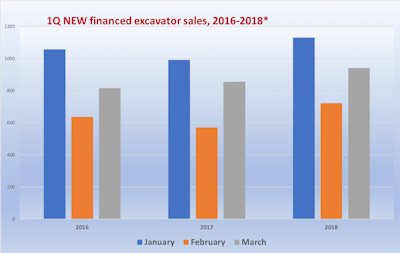

The Komatsu PC138USLC-11 was a top new excavator model financed in the first quarter of 2018.New financed full-size excavator sales started the year with a bang, with first quarter new equipment sales increasing by 9 percent compared with the same period last year, and by 14 percent compared with the three year average, according to an Equipment World analysis of EDA data.

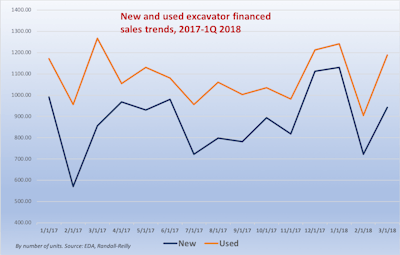

January was the strongest month for 1Q new excavator financed sales for the past three years, averaging 1,060 units. For all three months during this three-year time period, an average of 2,575 new units were sold.

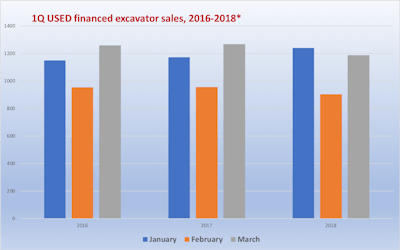

On the used side, the strongest month this year was January when 1,241 used excavators were financed. In 2016 and 2017, however, March was the strongest used excavator sales month in the quarter. The number of used excavators financed has held steady during the past three years, varying by less than 100 units.

Compact excavators, also called mini excavators, were not included in this data.

Who bought excavators in 1Q?

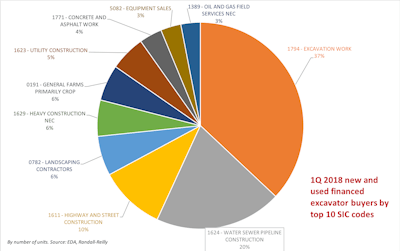

As with wheel loaders, it’s no surprise that buyers identified by the Excavation Work SIC (Standard Industrial Classification) code bought the most financed excavators in the quarter. Just looking at the top 10 excavator buyer SIC codes, Excavation Work companies financed 1,530 new and used excavators, and made up 37 percent of the total. This was far ahead of buyers identified by the Water Sewer Pipeline Construction SIC code (20 percent, or 821 new and used units financed) and the Highway and Street Construction SIC code (10 percent, 425 units).

What did they buy?

Caterpillar, Deere and Komatsu were the top excavator brands financed in the quarter when looking at the number of used and new machines sold. The No. 2 and 3 positions shifted when looking at new and used units separately, however. Deere claimed the No. 2 position in new equipment financed but dropped to No. 3 behind Komatsu in the number of used excavators sold.

After the top three brands duked it out, the No. 4 position — held by Volvo in financed new excavators and by Kobelco in used excavators — sold less than half the number of units sold by the holder of the No. 3 position.

During the quarter, the Cat 336F L, at 184 units, was the top new model sold, followed by the Deere 210G LC at 119 units and the Komatsu PC138USLC-11 at 102 units. In used units, the Cat 336F L and Cat 320E L tied for top of the list, with 70 units sold each, followed by the Deere 210G LC. (Note: Equipment models typically have a three-year life, and so can be sold as both new and used units in the same time frame.)

Considering both new and used units sold during the quarter, the 460 units sold in Texas were almost double the amount sold in the next state, Georgia, where 246 units were sold. Florida came up third, with 215 units sold.

By number of units. Source: EDA, Randall-Reilly.

By number of units. Source: EDA, Randall-Reilly.Data sample

EDA is a division of Randall-Reilly, parent company of Equipment World, which tracks UCC-1 filings, used by lenders when a machine is financed.

Depending on the type of machine, financed machines can represent 40 to 75 percent of the total number of machines of that type sold in the United States. While machines can also be bought by cash or letter of credit, which are not tracked by EDA, buyers of larger, higher priced machines tend to use financing.

EDA reports are continually updated, and these numbers, while representing the majority of the first quarter results, may have changed slightly since this data was pulled in late June.