Editor’s Note: This article was originally published in our 2020 Contractors Pickup Guide. The full guide features spec breakdowns, spec rankings, photos and everything new on the 2020 model year half-ton and full-ton trucks from each major manufacturer. Read on below and click this button to download the whole guide.

Download the 2020 Contractors Pickup Truck Guide PDF

If you’re like most folks after a vehicle purchase, you’ve probably left the dealership with mixed feelings. On one hand, this new truck smells and feels amazing. On the other you may be thinking, “How much money did that salesman squeeze out of me?”

The barrage of trim choices, options, paperwork, upselling and all the waiting for the salesperson to return from “one more” talk with the manager quickly turns what was intended to be a negotiation into feeling something more like being held hostage.

Which is why it’s surprising to find out that there’s a guy out there whose job it is to buy cars. It can be a miserable experience, but Tom McParland, owner of Automatch Consulting has been doing the dirty work of car and truck buying for customers since 2013.

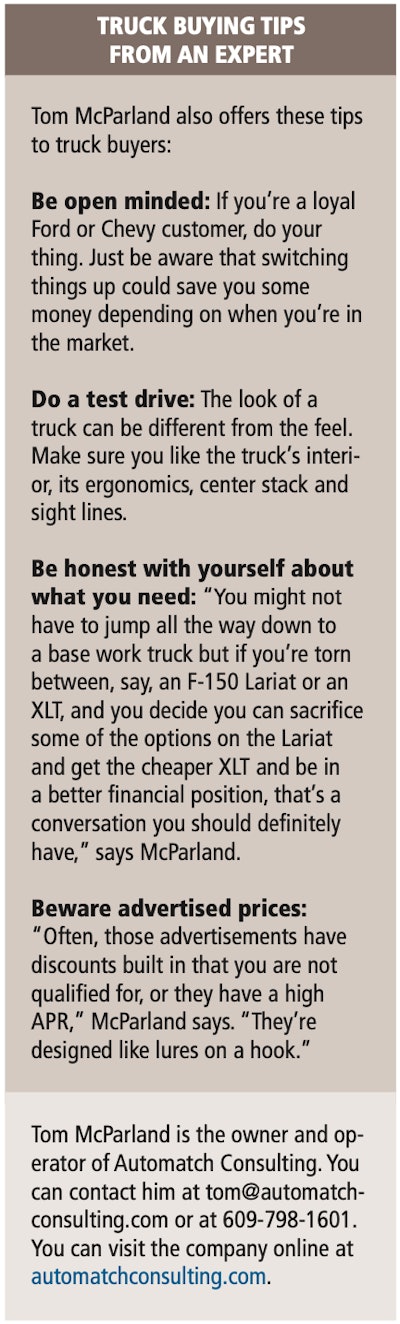

So we gave McParland a call to get his advice on buying your next truck. After all, trucks are typically a trickier purchase than a car or SUV due to the many configurations you can come up with between multiple trim levels, engines, transmissions, technology and other features.

Plus, trucks are more expensive than they ever have been, making it harder to leave the lot happy. “What has happened is trucks have supplanted luxury cars for a lot of people,” McParland says. “You can get a GMC Sierra Denali or a fully loaded F-150 Limited and they have similar features and feel and comfort to European luxury cars. But with the truck you have all the features of a pickup combined with that, and, for the most part, more durability.”

So, if you want to leave your next truck buying experience with confidence, here’s what McParland suggests you do.

Download the 2020 Contractors Pickup Truck Guide PDF

Avoid sticker shock and buy the truck you actually want

“A lot of customers think they’re going after a basic truck with cloth seats and a couple of extras and then they go into the online configuration and all of a sudden that’s a $48,000 truck,” McParland says.

What would be worse is receiving that sticker shock on the lot. It can put you off balance right off the bat, immediately calling into question whatever plan you had going in. And once the salesperson shows up, the added pressure could mean you walk off the lot with a truck you can’t afford.

“Do your research,” McParland says. “There’s a lot of math in making sure you’re not getting in over your head. One of the best defenses against getting ripped off is an online loan calculator. Do those calculations before you even walk into the dealership.”

McParland advises customers to figure out what you can afford in a truck payment every month, and then plug that amount into a vehicle loan calculator at 5 percent interest. (You will likely do better than 5 percent, but McParland says its a safe number for this type of estimation.) The calculator will then tell you the max price you can spend on a new vehicle.

“Too many people go to the dealer with a monthly payment. They go in and say ‘I need to pay X amount of dollars each month,’ and all of a sudden they’re signed up for an 84-month loan,” McParland says. “And with a long-term loan you might be underwater immediately.”

“You’re on their turf there. These guys make car deals every single day. This is what they do. They want you to go through the marathon and the back and forth and to get you to the point where after four or five hours you’re saying ‘Just give me the truck and get me the heck out of here,’” he says.

“Once you decide on the truck, your options, your features and colors, contact dealers by phone or by email and say ‘Hey I’m looking for this truck with these features. Send me a window sticker or send me a link to the vehicle online, and then I need you to send me your best price. I need to know the sale price of the vehicle, the rebates, the taxes, the fees and the total.’ A full itemized breakdown.

“You want to get everything in writing and all laid out in black in white, before you walk in and start signing papers.”

McParland advises strongly that you send this request to multiple dealers. The reason? On any given vehicle, dealers can arrive to a final price in different ways.

Finding the right path

You might be feeling pretty good at this point. You’ve done the homework, you’ve avoided the dealership trap. Unfortunately, this is where the hard work in getting a good deal on a vehicle begins, McParland says.

Where things can get really confusing in this whole process is how rebate programs work. As McParland explains, there’s often multiple “pathways” you can take based on how you pay for the vehicle and what kinds of discounts the dealer or manufacturer is offering. Each pathway can lead to different prices, so it’s important to look closely at what a dealer is offering

McParland gave us three potential pathways you could encounter:

Cash Buyers: “By cash buyer, dealers don’t mean pulling money out of the bank. They mean you’re simply not using manufacturer financing. Cash buyers will get a certain rebate tier, maybe a couple of grand off the truck.”

APR Special: “When you choose to finance at a low APR, you save over the life of the loan, but up front you give up some rebates.”

Advertised Rebates: “This is where dealer advertisements get—I wouldn’t call it sneaky—but you want to take a lot of these advertised prices with a grain of salt. On these, you’ll get the maximum amount in rebates, maybe $4,000 or $5,000 off the truck from the factory before any dealer discount. But the caveat here usually is that you have to take the manufacturer’s loan at a high interest rate, usually 6.25 to 6.5 percent. So when you look at the loan math over time, that interest completely neutralizes the rebates they gave you.”

With this in mind, it’s important to understand that the prices you solicited from multiple dealerships are hardly ever apples-to-apples.

“That’s why getting the itemized breakdown is crucial. The out-the- door price matters, but one of the other pieces is the gap between the MSRP and the dealer sale price prior to any rebates,” McParland explains. “Because the rebates are going to come from the factory no matter which pathway you take. So it just depends on what’s most advantageous for the customer based on their financing situation.”

McParland gives the following example to explain what this could look like:

Dealer A has a $54,000 truck that it is selling for $50,000 before rebates. That’s $4,000 out of their pocket right off the top. Dealer B on the other hand has a $54,000 truck and they’re selling it for $52,000 before rebates. “So even though Dealer B might be using a stronger rebate program, they’re not offering as aggressive a deal off the top,” McParland says.

After receiving your pricing breakdowns from the dealers you contacted, carefully review how each dealer is getting to their final price.

Those truck buyers interested in a Toyota or Nissan can have an easier time with all of these pathways, McParland says, as import automakers tend to be more straightforward with their rebate programs.

Buy your truck

Once you’ve landed on a truck deal you’re happy with, head into the dealership with all of your paperwork and buy your truck, McParland says.

If this sounds like a lot of work, that’s because it is. After all, McParland has built a career out of it. He says he and his staff earn most of their pay after the dealer prices start rolling in as they try to figure out what buying pathway is most advan- tageous for a particular customer.

If you want truck-by-truck breakdowns on every major half-ton and full-ton 2020 model year pickup, download our full Contractors Guide to Pickups with the button below:

Download the 2020 Contractors Pickup Truck Guide PDF