Most respondents (58 percent) said they had between 1 to 5 service trucks in their fleet; another 15 percent had 6 to 25 trucks.

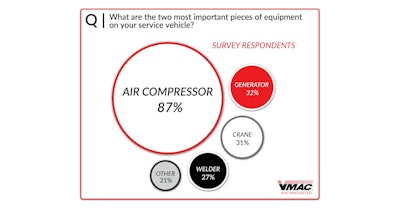

Still, not all of the respondent’s service trucks had an air compressor. When VMAC asked what percentage of respondents vehicles had this equipment, only 28 percent indicated that all of their service trucks were equipped with one. Another 30 percent said that less than 10 percent of their fleet had an air compressor.

Getting down to equipment specs, 40 percent of respondents said that 120-149 psi compressors best fitted their requirements. Other popular psi ranges included 100-119 psi (25 percent) and 150-174 psi (22 percent). The response was more evenly divided when asked about preferred cfm range. Thirty-one percent indicted their preference for 30 to 59 cfm, 25 percent said that 60 to 99 cfm best met their requirements and 23 chose the “up to 29 cfm range.”

Respondents showed a decided preference for rotary screw compressors (67 percent) over reciprocating (33 percent), with performance (83 percent) cited as the number one reason why. VMAC adds that respondents choosing reciprocating compressors cited their ease of repair.

Deck-mounted air compressors were the overwhelming choice of respondents, with 69 percent saying they preferred this style. Three types of air compressors were the top choices, all within three percentage points of each other: above-deck gas engine drive (22 percent), above-deck diesel engine drive (19 percent) and underhood/engine drive (19 percent).

The three most common air tools on these trucks were impact wrenches (75 percent), tire inflators (64 percent) and blow gun (41 percent).

The air compressor manufacturer surveyed 205 people in this survey, made up of primarily those who said they were in construction (41 percent), heavy equipment (40 percent), general equipment (32 percent), utilities infrastructure (23 percent) and tire service markets (22 percent) markets, among others. (Note: multiple market answers were accepted.)