Sunbelt’s nine‑month results in the U.S. rental and related revenue have once again surged, now by 19 percent, as Sunbelt continues to benefit from generally strong end markets and to a lesser degree, the impact of hurricane clean-up efforts.

Geoff Drabble, CEO of Sunbelt’s parent company, Ashstead Group, says overall, rental revenue is up 18 percent year on year for the group. An expansion strategy includes adding 112 locations year to date, as part of a much bigger plan for Ashstead to broaden its reach by 2021.

During an investors’ call this week for Ashstead Group’s third quarter earnings report, Brendan Horgan, Ashstead’s chief operating officer, pointed to another strong quarter from Sunbelt.

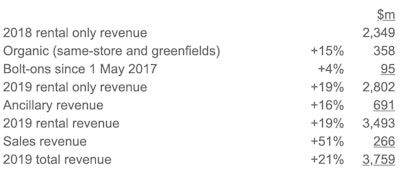

Rounding off revenues at a 20-percent hike, he says, the organic momentum continues, with 15 percent revenue growth, while the benefits of bolt-on activity throughout the year contributed an additional five percent.

“This growth is a result of our continued execution of our 2021 plan, as well as strong market dynamics,” he says.

“Utilization continues to be at strong levels and importantly, it is coupled with a good rate environment. We had difficult comps in each of these measures, with far more hurricane activity in last year’s Q3, so these results demonstrate further the strength in our end markets.”

He stresses a favorable rate environment.

“Regardless of hurricane comps, rates on an absolute basis were better than a year ago,” Horgan says. “Further, I should note that February rates are already nearing 2018 mid‑summer levels, which indicates a very healthy rate environment as we enter the spring season.”

Michael Pratt, Ashstead’s finance director, says the good quarter and nine months brought strong growth in revenue and profitability.

“The group’s rental revenue increased 18 percent on a constant currency basis and we maintained margins despite opening 62 ‘green fields’ and completing nine acquisitions in the period,” he explains.

The operational efficiencies in mature stores offset the drag effect from new stores, resulting in an EBITDA margin of 50 percent, the company says.

The group reported that operating profit improved 21 percent, to $1.2 billion at a 32 percent margin.

“The EBITDA margin was 48 percent and the operating profit margin 29 percent. As a result, underlying pre‑tax profit was £888 million, up 18 percent at constant exchange rates,” says Pratt.

“The more significant 34 percent increase in underlying earnings per share reflects the benefit of the lower U.S. tax rates, resulting in an overall effective tax rate for the group of 24 percent this year compared with 31 percent, last year and a lower share count as a result of the share buy‑back program.

Sunbelt US’s revenue growth continues to benefit from various cyclical and structural trends.

A year ago, it was much the same as with these two latest hurricanes. Ashtead had seen demand in its U.S. division as it supported clean-up efforts after hurricanes Harvey, Irma and Mari.

Turning to Sunbelt in Canada, slides for investors demonstrated how the scale of operations in Canada has been transformed by the acquisition of CRS last year and to a lesser extent, Voisin’s this year.

As a result, year-over-year comparisons are not particularly meaningful, the report says.

“In absolute terms, Canada contributed $257 million in revenue and $47 million in operating profit in the period. In a period of rapid growth, the key is to strike a balance between growth and profitability. Canada has achieved this, delivering an EBITDA margin of 37 percent and an operating profit margin of 18 percent.”

Consistent with the company’s capital allocation framework, Ashstead invested $1.84 billion to grow the fleet in a strong US market and continued to take market share.

The quarter-end, year-to-date margins remain at the same strong levels as the same period last year, while ROI has improved to 24 percent.

Pratt notes the momentum behind specialty growth:

“We’ve added 42 specialty greenfields in the year and further complemented this specialty business growth with two key bolt-ons in the quarter,” he says. “Specifically, we acquired Apex, which is a three-location pump business and Underground Safety, an eight-location trench-work business, both of which closed in November.”

Also added was Temp‑Air, a 13-location climate control business, and more additions are expected as the outlook remains bright.