As bills and payroll pile up, some general contractors are resorting to risky ways to make ends meet while they await payment.

A new report from construction finance software provider Rabbet found the number of general contractors using retirement savings to float payments for their business has increased 8.5 times in the last year.

It’s a move that has serious consequences for both business owners and the industry at large.

But it’s not just retirement funds that contractors are dipping into.

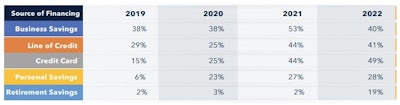

In the past year, 49% of general contractors claimed they rely on credit cards, followed by a line of credit (41%), business savings (40%), personal savings (28%) and retirement savings (19%) to float payments. In contrast, only 2% of general contractors reported tapping into their retirement savings in 2021.

General contractors rely on various financing sources while awaiting payment. Notably, there was a nearly 17-point increase from 2021 to 2022 in the reliance on retirement savings.Rabbet

General contractors rely on various financing sources while awaiting payment. Notably, there was a nearly 17-point increase from 2021 to 2022 in the reliance on retirement savings.Rabbet

Because contractors must include enough capital in their bids to account for this overhead, the report found that the cost of floating payments for wages and invoices represents $208 billion in excess cost to the industry, a 53 percent increase from 2021. Nearly two-thirds of general contractors incurred billing charges, financing charges or other costs when floating payments to others.

As GCs take on additional financing costs, those costs are passed on to real estate developers and financiers in the form of project delays, added risk and higher bids from contractors. An estimated $121 billion in additional overhead was included in general contractor bids to finance slow payments. And they weren’t alone – subcontractors also added $87 billion in additional costs to account for delays.

So, what is the real cost of slow payments? Rabbet says cash flow is king, and without reliable, timely sources of income, contractors have a significantly higher risk of going out of business in 2022 than they did a year ago. In 2021, general contractors reported that rising material costs were their number one concern negatively impacting cash flow or preventing them from bidding on a project. This year, rising materials cost is the number one concern, closely followed by inflation.

"As these realities set in, the implications for contractors grow tremendously," said Will Mitchell, CEO of Rabbet. "The risk of contractors going out of business skyrockets in environments like this and furthers the necessity for a better payment process in general. Contractors are clearly feeling this strain considering there was an 8.5-times increase in general contractors using retirement savings to float payments for their business.

"When general contractors and subcontractors are in a situation where they can’t sustain their businesses because of disjointed payment processes, the risk to both lenders and developers grows immensely. Developers can't control inflation and materials costs. The greatest opportunity to reduce project costs and attract and retain the best contractors is by implementing systems to get people paid quickly."

To compile the data, Rabbet distributed a survey in September to general contractors and subcontractors on how they managed working capital, bidding decisions, and project risks in the face of slow payments during the last 12 months. Of the 137 respondents, 43% were subcontractors and 57% were contractors located in the U.S.