Cummins has taken another step toward a goal of developing zero-carbon solutions by announcing its acquisition of Meritor, a Michigan-based supplier of drivetrain, mobility, braking, aftermarket and electric powertrain solutions for commercial vehicle and industrial markets.

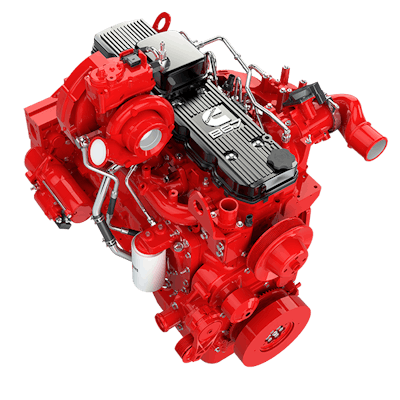

The news follows Cummins' recent announcement of new engine platforms that will be able to run on a variety of fuels, including natural gas and hydrogen.

“Meritor is an industry leader, and the addition of their complementary strengths will help us address one of the most critical technology challenges of our age: developing economically viable zero-carbon solutions for commercial and industrial applications,” says Cummins CEO Tom Linebarger.

Cummins says the acquisition will accelerate development of its electric-power solutions. One area of interest for the engine manufacturer is e-axles. “Cummins believes eAxles will be a critical integration point within hybrid and electric drivetrains,” the company says. “By accelerating Meritor’s investment in electrification and integrating development within its New Power business, Cummins expects to deliver market-leading solutions to global customers.”

Cummins says it also plans to accelerate Meritor’s core axle and brake business, and the acquisition is expected to create synergies in cutting costs, improving supply chain operations and facilities optimization.

“This agreement with Cummins builds on Meritor’s track record of outstanding performance and service to our customers,” says Meritor CEO Chris Villavarayan. “Our offerings will continue to play an important, strategic role as commercial vehicles transform to become electric and autonomous.”

Cummins says it will pay $36.50 per share for Meritor stock for a total of $3.7 billion.

Villavarayan says Meritor shareholders will receive a 48% premium on their shares as of February 18, and the business will benefit from Cummins’ additional investment in its axle and brake development and for electric vehicle adoption.

The transaction is subject to regulatory and Meritor shareholder approval. The deal is expected to close by the end of this year, Cummins says.