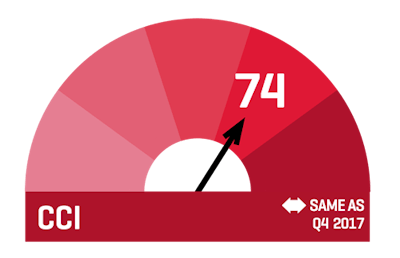

The commercial construction industry has continued its optimism from 2017 into 2018, with increases in new business prospects, rising revenue forecasts and steady backlogs, according to the Commercial Construction Index.

And for the third consecutive quarter, a higher percentage of contractors report that they expect to spend more on tools and equipment in the next six months – 59 percent for 1Q 2018, up from 55 percent in 4Q 2017.

The ability to find skilled workers, however, continues to be a hurdle for 56 percent of contractors for the first quarter of 2018, which is the same level as the fourth quarter of 2017.

Drivers of the index include:

- High contractor confidence for new business prospects over the next 12 months, which is up 1 point to 76.

- Most contractors expect revenue growth in the next year, up 1 point to 72.

- 80 percent of contractors report steady or increasing backlogs. The average backlog is 8.9 months, which is 73 percent of the ideal backlog of 12.2 months. “Overall, the ratio suggests a strong market with room for growth,” the report says.

Hiring continues to be a challenge

The index reports 58 percent of contractors expect to hire more workers, a 1-percent increase from fourth quarter 2017, but a 6-percent drop from first quarter 2017.

The same percentage of companies – 56 percent – reports having difficulty finding workers between 4Q 2017 and 1Q 2018.

Smaller companies of $10 million in revenues or less are reporting the most difficulty in hiring skilled workers, at 65 percent. That compares to 41 percent of large contractors of $100 million or more in revenue reporting difficulty.

The biggest labor shortages are for concrete, masonry, interior-finishes and electrical workers.

Contractors in the Midwest report the highest percentage of those planning to hire in the next six months, at 68 percent. The Northeast reports the lowest percentage, at 38 percent. The West reports 59 percent and the South 57 percent.

Bigger investment in equipment and tools

The percentage of contractors who expect to buy tools and equipment over the next six months has risen form 47 percent in the first quarter of 2017 to 59 percent in 1Q 2018.

“These findings suggest that as contractors invest more in their businesses, they see increasing revenues and margins,” the report says.

Indeed, contractors were more confident their revenue would rise over the next 12 months, from 47 percent in 4Q 2018 to 54 percent in 1Q 2018.

That optimism is carrying over to expected profit margins over the next 12 months, with 39 percent foreseeing an increase, up 4 percent from 4Q 2017.

The percentage of contractors expecting sufficient business opportunities in the market for the next 12 months rose 11 percent to 62 percent from Q4 2017 to Q1 2018. That’s a higher measurement than for all of 2017, the report says.

Offsite construction gains traction

The report indicates growing use of prefabricated and modular components by general contractors.

“The recent growth in these approaches is likely driven by their benefits, such as increased jobsite efficiency,” the report says.

The report also indicates such approaches may provide relief from the labor shortage.

“There is significant opportunity to introduce innovations that confront jobsite efficiency and strengthen the industry – such as solutions that enable prefabricated and modular building components,” says Jennifer Scanlon, president and chief executive officer of USG Corp.

Two-thirds of general contractors using prefabrication or modular components expect demand to increase over the next three years, “which suggests the industry believes that prefabrication/modular approaches are gaining traction,” the reports says.

The most demand for such approaches is found in the hotel, health care, manufacturing and multifamily sectors. The top uses are for exterior walls, building superstructures and MEP building systems.

Contractors listed the following benefits of prefabrication/modular: increased efficiency onsite (89 percent), improved labor productivity (85%) and reduced schedule and waste (79 percent).

To read the full report, click here.