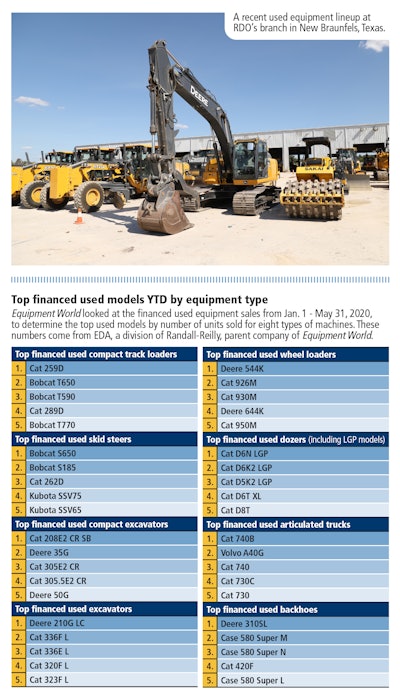

A pause on live auctions: Ritchie Bros. converted to online-only auctions in response to the pandemic.

A pause on live auctions: Ritchie Bros. converted to online-only auctions in response to the pandemic.Used equipment is playing an increasing role as equipment buyers struggle to navigate 2020’s strange environment.

Finding used equipment doesn’t have to be frustrating.

The new Equipment Experts online marketplace makes it easy – with detailed filtering, equipment specs and payment calculators.

Click Here to Download Our Full Used Equipment Market Report

Used equipment sellers had to forgo the typical March madness this year, says Jay Germann, general manager for used equipment, Roland Machinery, a Komatsu dealer based in Springfield, Illinois. “But we had a great April, well over our anticipated number. May was good, and we feel June will be strong because we have a lot of machines that are booked and ready to be delivered.”

“There’s still a lot of work going on,” says Randy Arrington, used equipment manager for Empire Cat in Arizona and southern California. Companies with large fleets aren’t dumping equipment because they’re keeping it utilized, he says. As a result, pricing for used general-construction machines has held steady.

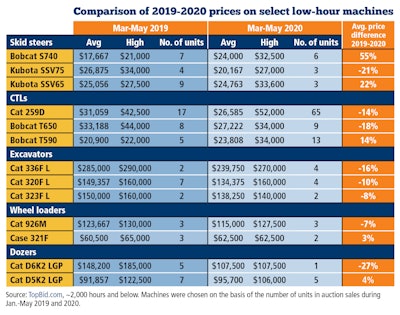

Cat has seen used equipment prices drop 6 percent through April year over year, says Nick Yates, used equipment sales and operations manager, Caterpillar. “But while year-over-year pricing might be down, month-over-month pricing for the past five months is relatively stable,” Yates says.

Used equipment prices are “now at or better than they were three to six months ago,” says Howard Hawk, president of the online auction site Bidadoo. He says this is surprising in light of decreases of 5 to 15 percent seen in spring.

“We expected to see a further decline or for them to stay depressed, but they’ve definitely bounced back, and in some cases are up 10 percent from the beginning of the year,” Hawk says. “We’re seeing a tremendous amount of demand out there.”

Online-only

Stay-at-home orders in spring prompted auction companies with live auctions to move to online-only platforms. It wasn’t a hard right, however. Ritchie Bros says 65 percent of its transactions were already conducted online before the pandemic.

For the three months ending in May, Ritchie says used equipment prices declined around 3 percent compared to the same period last year. “We were actually starting to see deflation in prices in 2019,” says Ken Calhoon, vice president of data analytics for Ritchie Bros. “Now we’re seeing that the price deflation has somewhat flattened and stabilized across Canada and the U.S. and even internationally. We’re encouraged to see this stability, and it’s certainly not what we saw through 2008 and 2009.”

“If we look at our top 15 equipment categories, the vast majority are performing above expectation right now,” Calhoon adds.

What’s helped is that a financial crisis did not precede the pandemic, says Doug Olive, Ritchie senior vice president of pricing. “Credit is still available and there’s still work.” Demand is also good, even as Ritchie has pivoted to online-only auctions. The company’s Edmonton, Canada, auction on May 18th set a company attendance record of 23,500 online bidders. Its Fort Worth, Texas, auction June 2-3 had a site-bidder record of 11,600 registered attendees, the first time that particular sale site had eclipsed 10,000 bidders. “We did have a large oil-and-gas dispersal in that sale, and it performed better than our expectations, as did the construction equipment.”

“All in all the demand is still strong,” says Chris Deason, U.S. business development manager with Yoder & Frey, a division of Euro Auctions. Yoder & Frey has resumed live auctions after online-only sales in spring. “Still, 70 percent plus of the bidders are online,” he says. “Equipment prices have held steady throughout everything; most values have seemed pretty consistent.”

Bidadoo reports its web traffic has doubled year over year. In May, it saw a 66 percent sales increase compared with May 2019. And 62 percent of its traffic is now from mobile devices.

This spring saw many bidders new to the online experience, according to Hawk. Questions from these buyers centered on “how does it work?” “how much does it cost to ship?” and “can I trust you?” he reports. All of which Bidadoo had ready answers for; the 17-year-old company has been online-only from its start.

While Bidadoo works in partnership with eBay, eBay also sells used equipment. “Specific to eBay’s heavy equipment vertical, 2019 was a strong year and that velocity persisted through the start of 2020,” says Nick Stalcup, eBay head of heavy equipment, parts and attachments. “Around the time the public health policies were enacted, and swaths of the consumer and business populations were forced to shop almost exclusively online, eBay did see accelerated growth as users looked for new avenues to dispose and purchase equipment.”

Location, location

RDO’s footprint covers nine states. Howard says, “You could almost watch as a state started opening back up that the equipment discussions in those markets started happening. We’re not where we were, but we’re definitely trending in the right direction in both a demand and value standpoint.”

Both Texas and North Dakota, tied to the oil field, have seen equipment demand drop dramatically, Howard says. The machines used in this market – mid-size excavators and dozers – have also seen decreases in demand. But Howard notes that major metro areas such as Dallas and Phoenix have come back after the drop in the initial stages of the pandemic.

While oil and gas is definitely down, Deason says, customers in these markets are saying the banks are not forcing asset sales yet. “But it’s coming,” he says. “Inventories out in West Texas are packed full of gear.”

“What’s keeping us up in Arizona is housing, which is very active,” says Arrington, and housing is a market that attracts compact-equipment buyers who tend to trade after three years, 3,000 hours. “The next guy who wants to start his own business is right behind them wanting to buy that piece,” he says.

“We’ve been fortunate in our areas that contractors have been able to keep on working,” says Kenneth Tysinger, used equipment sales, May-RHI, a division of National Equipment Dealers. May-RHI covers North Carolina and South Carolina and carries Hyundai excavators, Hitachi wheel loaders and Bell articulated trucks, among other lines.

Factors in play

Not all of this summer’s used equipment market realities are pandemic-related. Equipment cycles and the impact of the Great Recession were still in play, Hawk says. “This year was already going to be a large used-sale year, but the situation has put that on steroids.”

Hawk says the start of the last decade – still reeling from the Great Recession – saw lower new equipment volumes coming out of manufacturing plants, followed by a large buying cycle in 2011-2013. If the market follows a typical seven- to eight-year cycle, now is when the industry is selling.

Also in play: the general uneasiness that buyers have in any election year. “In every presidential election year as long as I’ve been in the business, people get reluctant to pull the trigger on jobs,” Deason says. “This slows spending just because of the concern of who is going to be in office and whether or not they are going to be pro construction.”

Lease returns, which typically run three years/3,000 hours, are also in the mix, Germann says. “Used equipment is much more available right now, which has led to prices becoming soft, but that’s a trend that’s been happening for quite some time,” Germann says. “A lot of lease returns are happening for all manufacturers and it’s somewhat flooding the market right now with quality used equipment. Two to three years ago, you couldn’t find low-hour, late-model equipment, but now there’s an influx of new stuff coming into the market.”

What’s hot

“All of our wheel loaders, excavators and artics have remained relatively strong in the used market,” says Tara Stryker, director of remarketing, Volvo Construction Equipment. Her division handles the equipment that comes off Volvo Financial Services leases. Year to date, artics make up about 45 percent of the company’s used sales, with wheel loaders (17 percent) and excavators (16 percent) as the top three products. Machines coming off lease are typically three years old with about 4,000 hours, she says.

As always, “late and low,” meaning late-model, low-hour equipment usually defined as 2,000 hours and under, trends differently than the rest of the used equipment market. “Those late and low machines never really saw the hit,” Howard says, “and that category is doing a bit higher than we thought it would be at this time of the year. It seems a lot of people are transitioning their buying patterns from new to that type of equipment.”

“We’re seeing a lot of strength for those later-model, lower-hour units from end users, dealers and brokers,” Olive says. “In the past few years, that type of equipment has been difficult to source. Right now, you can find these machines anywhere in North America.”

Deason agrees. “Before this, we weren’t seeing a lot of low-hour gear because fleet owners were keeping them because of new deliveries being so tight.” But now there’s more lower-hour units because the fleets are downsizing. “So there’s a lot more newer gear than you would have seen 12 months ago,” he says.

Cat is seeing large wheel loaders (350 horsepower and above) get higher-than-average prices. “Our hypothesis is that this is a combination of limited supply in the U.S. market and limited availability of new machines,” Yates says. “Whether it’s us or other manufacturers, there’s a good demand on the bigger gear, so that translates into higher prices.”

Also doing well: small and mid-size excavators, Germann says.

The Carolinas are also seeing mid-size excavator demand, as well as demand for articulated trucks, according to Tysinger. “But the excavator market is starting to change some because of all the machines that are coming off the pipeline and gas line projects in the Texas and Oklahoma area,” he says. “The 18- to 36-metric-ton excavators are starting to pile up and affect prices.”

Compactors and dozers are in less demand, Tysinger says. “A lot of the D6N-size dozers are coming off the pipelines as well. We’re starting to see dealers in other regions offer machines at lower prices, which will have an impact here on the East Coast.”

Another strong performing segment in Arizona is compact equipment – skid steers, compact track loaders and compact excavators. “Our sales dollars are down some but our unit count is up,” Arrington says. “General construction has been really strong.”

Conversely, Empire’s mining market is down because of lower production demands. It also represents the vagaries of the used market. “A year ago you couldn’t find anything mining for sale,” Arrington says.

Impact of new equipment sales

“One of the biggest drivers of used equipment pricing is the current availability of new equipment,” Yates says. “Customers have to fulfill their needs with equipment, and a used piece sitting on the ground is more readily available sometimes than new equipment.”

Some equipment manufacturing plants temporarily shut down in response to both the pandemic health concerns and lower demand. Temporary plant closings in spring included Cat’s excavator plant in Victoria, Texas, and its skid steer and compact track loader plant in Sanford, North Carolina. John Deere also temporarily suspended operations at its Dubuque Works construction and forestry plant in Iowa.

“We were having some trouble getting certain models of new equipment such as our intelligent dozers before the pandemic,” Germann says. “With some factories being temporarily shut down, that put a strain on some other models. There are some models we can’t get for several months, and if a guy has immediate needs, he’s going to turn to used.”

“In early spring, we went out and bought some lease returns on the open market with under 3,000 hours, and we’ve sold them all,” Germann says.

In the coming months, the impact of reduced production from these temporary closings and production slowdowns will make itself fully felt in the market, Howard says. “If the jobs hold, we’re going to see an equipment demand over the next six to nine months, and values will rise on late-model, low-hour equipment,” he says.

Attracting today’s buyers

When the state of Illinois issued stay-at-home directives, Roland Machinery went to plan B on contacting customers. “We couldn’t visit our customers, so we changed our market strategies,” Germann says.

A simple solution proved effective: Roland made one-page flyers, took screen shots of them and sent them out through text and social media. “I don’t think email works,” Germann says. “But if people get a text message, they look at it. And we ended up getting on every social media platform in a big way, and all of that has driven some sales. It really helped our April results, and we’re going to continue to use this method.”

“It’s digital, digital, digital these days to attract buyers,” Empire Cat’s Arrington says. “This includes video and full-blown inspections online; not four pictures of the machine, but 40 pictures. You want the buyer to know that you’re accurately representing the tractor that they are looking at. We are moving into a digital space where you are shopping and buying with confidence online.”

“Our motto is ‘no surprises,’” Arrington continues. “It shows up the way it was inspected, and if it’s not, we’ll either buy it back or make it right.” To further ease buyer concerns, Empire is working on a project to flat-rate freight by a buyer’s location. “Freight adds no value, but you still have to transport tractors,” he says. “We’re looking at ways to minimize the impact of freight cost and take out the humps and dips.”

Manufacturers also promote their certified used rebuild programs as a way to ease buyer concerns.

“The biggest risk in used equipment is the unknown,” Volvo CE’s Stryker says. “Every used machine has its own story to tell, and if you don’t know what that story is, it’s a huge financial risk.” The Volvo certified used program, for example, gives machines a lifetime frame warranty and a six-month, 1,200-hour powertrain warranty. About 40 percent of the machines coming off Volvo Financial Services leases go into Volvo’s certified used equipment program.

“This allows a buyer to confidently look at a piece of equipment without going to kick the tires,” Stryker says. “It’s important that they know where that machine is in its life cycle, the machine’s previous applications and how much wear it has left.”

Murky crystal ball

“Having backlog gives contractors the confidence to buy equipment,” Germann says. “A lot of contractors we talk to in our area don’t see their load of work extending out past 2020. They have work through 2020, but going into 2021 they are uncertain.”

Germann says Roland Machinery budgeted for a flat year in 2020 and now estimates sales will be down. “The good news is that our gross profit margins are off just a small percentage. And that may be because guys are turning to used to buy instead of new, and they are paying a bit more for it. But in 2021, we’ll budget down or flat.”

Whatever happens, watch used equipment pricing. “Used equipment pricing tends to lead any significant changes in the market,” Stryker says. Coming out of a downturn, there will be a recovery in used prices before they appear in new equipment, she says. With unavoidable availability issues stemming from supply chain disruptions, expect increased demand for quality used equipment that can go right to work.

“We’re going to see a continued increase in selling activity throughout the year,” Hawk says. “The used equipment channels are going to be very, very busy. And because there’s not a lot of new equipment in the supply chain, the demand should remain strong and prices should be relatively positive.”

In summing up, Yates says, “You always have to be prepared to go up or down in this space.”