Cat’s new 14M3 motor grader

Cat’s new 14M3 motor graderBetween 2012 and 2016, Caterpillar experienced its most severe downturn in its 90-year history, with profits dropping by 40 percent. Now under the leadership of Jim Umpleby, who took over as company president this year, Caterpillar is focused on what it calls its “Operating & Execution” model.

“Profitable growth will be at the center of everything we do,” Umpleby said this week, sharing the company’s vision with Wall Street analysts. Another byword of the Umpleby era: discipline. “We will be disciplined in our investing” Umpleby said, “and have an operating and execution growth bias, prioritizing areas where we can develop a competitive advantage.”

Aftermarket services will be one key growth area, including an emphasis on the 500,000-plus assets (both machines and engines) now connected through telematics. “Our parts availability and coverage will continue to expand, and we will make it easier to buy Cat parts online,” Umpleby said. Customer service agreements (CSAs)—individualized to a client’s operation—also will be emphasized. “We have dealers who are already excellent at creating CSAs, and we want to expand that expertise across all dealers,” he said.

Cat’s Operating & Execution Model was front-center throughout the investor meeting.

Cat’s Operating & Execution Model was front-center throughout the investor meeting.Umpleby believes that a lean operational model will give Cat the ability to better weather the cyclical downturns in the construction, mining and energy industries. “We don’t want to depend on industry growth to maintain profits,” he said.

This was echoed in remarks made by Bob De Lange, Cat’s Construction Industries group vice president: “We’ve taken some significant cost reductions, which gives us more flexibility.” These cost reductions included chopping 7.9 million square feet off the division’s footprint, such as announced plant closings at Aurora, Illinois, and Gosselies, Belgium.

Cat will continue a multi-segmented approach to product development, De Lange said, most noticeable in its four-tiered wheel loader offering, which goes from the basic SEM models it offers in China to its premium XE models.

Financing, renting and 3D-printed parts

Cat’s global dealer footprint.

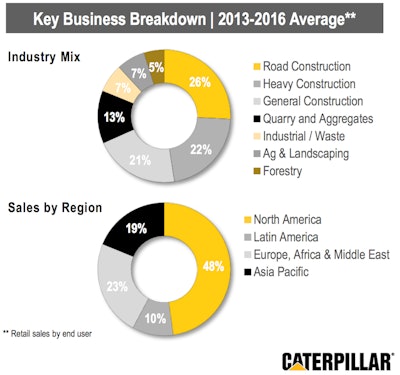

Cat’s global dealer footprint. Cat’s Construction Industries division, broken out by end user and region.

Cat’s Construction Industries division, broken out by end user and region.“Cat Financial and Cat Rents are becoming a bigger component of our dealer markets,” said Rob Charter, customer and dealer support group president. Another differentiator, according to Charter: the company’s 21 global distribution centers. Cat will focus on using data analytics to anticipate when a part is required and parts life cycle management.

And the company is exploring 3D printing capabilities to create parts. “It will shorten lead times,” Charter said. “We can have a part created anywhere.”

Three customer segments – large customers with integrated system requirements, customers with dealer relationships and first-time shoppers who want a more Amazon-type experience (such as those buying the company’s portable generators introduced last year) – each offer opportunities for Cat to further hone its customer service model, he said. “There are a lot of ways to support individual needs,” Charter said.

Even through the downturn, Cat said it “protected” two areas—R&D and digital—while putting more pressure on support costs. “The last four years have been really hard, but this company is absolutely stronger than we would have been without the downturn,” Umpleby said. “We had a huge reduction in our core costs and we’re well set to deliver on commitment to profitable growth.”