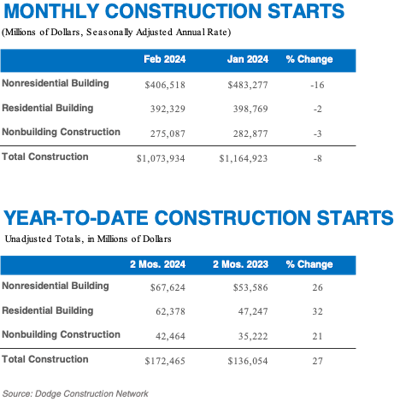

February was not a great month for the construction industry, with total construction starts falling 8% to a seasonally adjusted annual rate of $1.07 trillion, according to the Dodge Construction Network.

Per the latest report, non-residential building starts dropped 16%, while nonbuilding starts lost 3%, and residential starts fell by 2%.

On a 12-month rolling sum basis ending in February 2024, total construction starts were up 2% from year-over-year. This includes a 2% decline in nonresidential starts, a 4% decline in residential starts, and a 19% increase in nonbuilding starts.

Notable year-over-year declines occurred in the commercial, manufacturing, and institutional sectors. Commercial starts saw a 3% drop due to a sizeable pullback in warehouse starts. Manufacturing starts were off by 28% and institutional starts were down 19% with a decline in transportation and education construction.

“Construction activity was hit hard by higher rates and more restrictive credit standards”, said Richard Branch, chief economist for Dodge Construction Network. “Starts struggled over the past several months as the lagged effect of higher rates impacted projects moving forward through the planning process.”

Continued deficits in the skilled labor workforce also delayed projects, particularly in the manufacturing sector.

“While optimism should prevail in the second half of the year as the Federal Reserve begins to cut rates, some sectors like commercial, will make little headway over the remainder of the year,” Branch said.

Regionally, the Dodge report states that total construction starts in February fell in every region but the South Atlantic.

Dodge Construction Network

Dodge Construction Network

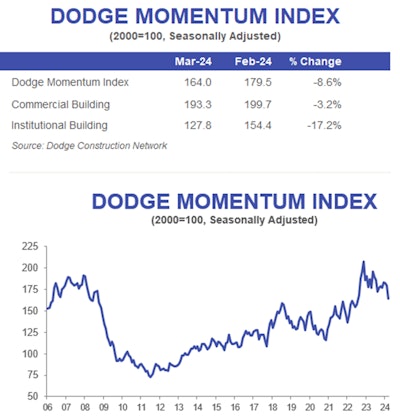

Dodge Index falls 8.6%

The Dodge Momentum Index (DMI), a monthly measure of non-residential building projects in planning that has been shown to lead construction spending for non-residential buildings for a full year, fell 8.6% in March.

Year over year, the DMI was 12% lower than in March 2023. The commercial segment was down 14%, while the institutional segment was down 10% over the same period.

“While strong market fundamentals should support institutional planning this year, this side of the Index is more at risk for a substantive correction after last year’s growth,” said Sarah Martin, associate director of forecasting for Dodge Construction Network.

Much of the decline on the institutional side is credited to lower levels of education planning.

Martin noted that life science and R&D laboratory projects accounted for about a third of the educational planning value in the past 12 months, sometimes rising to more than 50% in some months.

Those totals declined to a mere 7% in March, which suggests the lower lab volumes could result in education planning to return to its more sustainable average.

From a commercial view, continued slow growth in office and hotel construction drew down that portion of the index again.

Dodge Construction Network

Dodge Construction Network