Cautious optimism remains the buzzword to define the economic status of the construction industry following the first quarter of 2024.

The latest Rider Levett Bucknall (RLB) quarterly cost report states that construction costs were up 1.29% from Q4 2023, compared to higher rates of 1.5% or more throughout 2023. The increase mirrors that of pre-pandemic levels of 2019, and the year-over-year growth is just slightly higher than five years ago at 5.85% in Q1 2024.

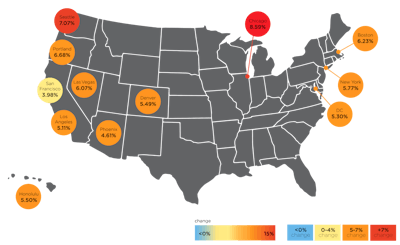

Boston, Chicago, Honolulu, Los Angeles, New York, and Washington D.C. all experienced increases over the national average this quarter. Denver, Las Vegas, Phoenix, Portland, San Francisco, and Seattle experienced gains that were less than the national average.

Construction-put-in-place during January 2023 was $2,102.4 billion, 0.2% below the revised December 2023 estimate of $2,105.8 billion, and 11.7% above the January 2023 estimate of $1,888.2 billion, according to the U.S. Department of Commerce.

“Despite having reached extremely high peaks, prices for construction materials are finally on a downward trajectory,” Paul Brussow, president of RLB North America stated in his editorial note.

RLB

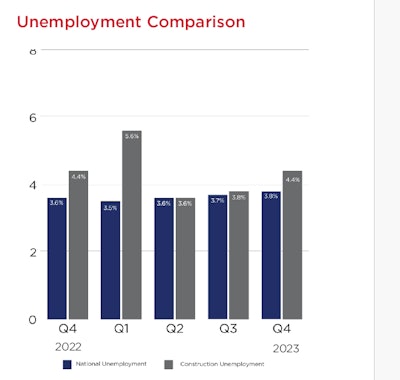

RLB

Brussow noted that prices are still rising as market participants attempt to reconcile the decline in private starts with longer-term requirements.

“While the growth of privately funded projects may be soft, public funding for manufacturing and infrastructure projects will help drive industry growth,” he said.

Maintaining a steady workforce remains a challenge within the industry. The construction unemployment rate is holding steady at 4.4 percent as compared to the same period last year.

Per the RLB report, construction employment has increased in more than two-thirds of metro areas in the last year, there remain approximately 400,000 job openings nationwide.

Brussow said this is an indication that construction companies need to prioritize investment in their existing workforce.

ABI indicates moderate growth

Analysis indicates that February’s AIA/Deltek Architecture Billings Index Architecture Billings Index (ABI) score of 49.5 is the most modest easing of billings since July 2023, suggesting that the recent slowdown may be receding.

The ABI score is considered a leading economic indicator of construction activity, providing an approximately nine-to-twelve-month glimpse into the future of nonresidential construction spending activity. It is derived from a monthly survey of architecture firms that measures the change in the number of services provided to clients.

“There are indicators this month that business conditions at firms may finally begin to pick up in the coming months,” said Kermit Baker AIA chief economist. He added that inquiries into new projects grew at their fastest pace since November, and the value of newly signed design contracts increased at their fastest pace since the summer of 2023.

“Given the moderation of inflation for construction costs and prospects for lower interest rates in the coming months, there are positive signs for future growth,” Baker said.

Regionally, the Midwest continued to report growth, despite the overall business conditions remaining weak across the country. Per the ABI report, Midwest firms have reported growth for the last three months and in four of the last five months.

“While the construction industry may still bear the scars of the recent tribulations, the pain will lessen as we head through the year.,” Brussow said. “Knowing what we know now, I’d describe our current situation as more of a ‘rebirth by a thousand adversities,’ as resilience has been the hallmark of our industry and is looking up in many ways this year. We can confidently navigate the path ahead through disciplined planning, investment in workforce development, and adaptation to market dynamics.”

RLB

RLB

RLB

RLB