The flurry of state gas tax legislation enacted earlier this year now goes into effect for a handful of states across the country, providing an increase in funding for much-needed transportation projects.

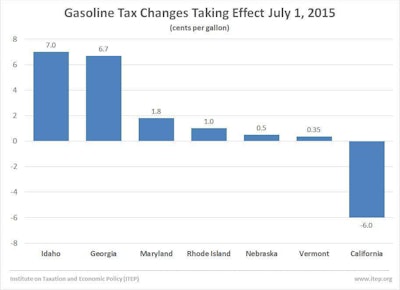

Georgia, Idaho, Maryland, Nebraska, Rhode Island and Vermont are all experiencing some bump in the state gas taxes collected. Idaho is the highest, at 7 cents per gallon, with Georgia close behind at 6.7 cents

Maryland (1.8 cents) and Rhode Island (1 cent) are seeing more modest increases as a result of previous policy changes.

Nebraska (0.5 cents) and Vermont (0.35 cents), however are barely registering increases that are due to variable-rate gas tax policies.

“While some drivers may view this as an unwelcome development during the busy summer travel season,” said Carl Davis, research director for the Institute on Taxation and Economic Policy, “the reality is that most of these ‘increases’ are simply playing catch-up with inflation after years (or even decades) without an update to the gas tax rate.”

Because of laws connecting motor fuel taxes to fuel prices, California gets 6-cent-per-gallon decrease in gas tax and a 2-cent per gallon increase in diesel tax. By the same policy, Connecticut’s diesel tax is reduced by 4.2 cents per gallon.