We were also interested in how a contractor’s buy list might change as he increased in size. For example, what would be the top three types of equipment for a contractor with annual sales of less than $5 million, compared to one with sales of more than $16 million?

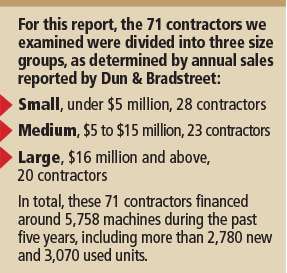

We further sorted this data by using a sample of the most active segment of excavating contractors – those who’ve bought 50 machines or more since 2010 – and defined by industry codes SIC 1794 (excavating contractor) and NAICS 238910 (site preparation contractors). (See box for our sample parameters.) Editorial judgment settled questions on the suitability of including a contractor into the sample.

Types of machines

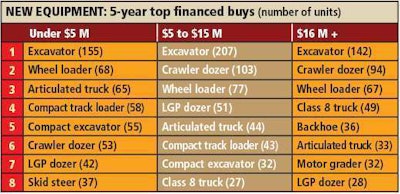

There were some significant differences in the top buy list of machines among the three different size segments in our sample of excavating contractors. While excavators naturally topped the list for all three sizes, the order from then on shows some different buying patterns, especially between small- and large-size excavating contractors. Large-size contractors had no compact equipment in their top buy list, and yet were the only size segment that included backhoes.

We should also note two items that appeared on the top new equipment financed lists that are not self-propelled machines:

- 80 light towers, bought by contractors in the large-size segment;

- Global positioning systems, bought by both medium- and large-size contractors. Medium-size excavating contractors in our segment, however, made 33 of their total 34 GPS purchases in 2011 and 2012. Large-size contractors had a totally different pattern, with 25 of the total 33 purchases happening in 2014.

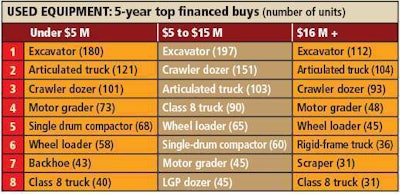

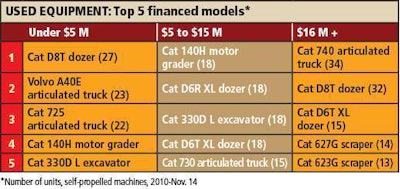

Looking at used financed sales in the past five years, two items are striking in this sample. While motor graders only made it to the large-size contractor list in new equipment buys, these machines appeared on the used top buy list of all three sizes of contractors. Compared to the new top buy list, small-size contractors in our sample prefer to buy their backhoes used rather than new, and their compact equipment (skid steers, compact track loaders and compact excavators) new rather than used.

Top models

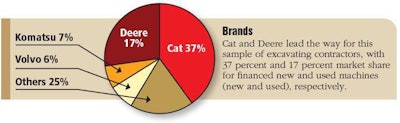

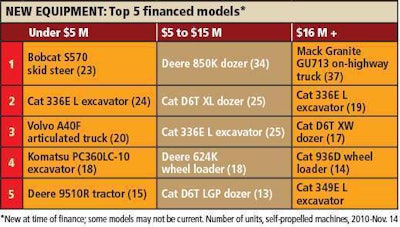

In our sample, Cat’s popular 336E L excavator appeared on the new top list of all three sizes of contractors. While contractors seem more willing to consider multiple brands when purchasing new, the top financed used chart was dominated by Cat machines, with the exception of the Volvo A40E articulated truck.

New sales trends

Although the 2014 tally does not include December, large-size excavating contractors in our sample were clearly financing more machines in 2014 than in 2013. The large-size segment saw a whopping 47 percent increase through November 2014 compared with all of 2013. Medium-size contractors financed 26 percent more machines during the same period. Small-size contractor buys, however, took a dive in 2014, decreasing by almost 35 percent.

Past history with this sample indicates the bonus depreciation, enacted in mid-December, may not have a significant impact in the final 2014 tally. The 2014 bonus depreciation allowed business owners to take an additional 50 percent depreciation above the Section 179 deduction on construction equipment bought during the year, lowering their taxable income. This depreciation also was in effect in 2012 and 2013, and yet there was only a pronounced buying surge in December in our sample group in 2012 and then only with the large-size contractors. (It must be noted, however, that contractors knew throughout these years they could apply the bonus depreciation to any new purchases made that year; in 2014, this knowledge came so late the impact was probably muted.)

Used sales trends

Used equipment buys by our excavating contractor slice were much more erratic, generally trending downward for the past two years. Financing a total of 1,206 used machines during the past 5 years, medium-size contractors edged out small-size contractors, who financed 1,061 machines. Large-size contractors were the least likely of the three groups to financed used machines, at 801 units. Since the bonus depreciation only applied to new purchases, it will have no impact on 2014 financed used purchases. However, Congress also reinstated the Section 179 deduction in the same bill as the bonus depreciation, which could be applied to used machine buys.