The Federal Reserve has raised interest rates eight times since December 2015, including the September increase that raised it to 2.25 percent.

Since construction equipment is usually a big-ticket item, these rate increases can have a significant impact on contractors, dealers, rental companies and material producers, says Peter Gregory, senior sales manager, manufacturer accounts and dealer inventory, Wells Fargo Equipment Finance.

Writing in the WFEF’s Construction Quarterly, Gregory says, “If a business has been reliant on floating rate debt, of which many are revolving bank lines of credit, their rates are increasing and their interest costs are higher.” Those using fixed rate debt, however, will not feel immediate impacts, since only new debt will be at the higher rate.

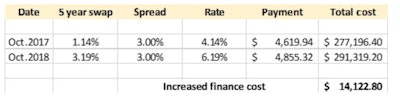

This means, however, the cost to by a new machine will be higher. Gregory uses an example of a contractor financing a $250,000 machine for 5 years at a fixed rate of the 5-year swap plus 300. Here are the costs for the past two years:

When you consider that this might just be one of several machines a contractor is buying this year, the increase in interest costs can be dramatic, Gregory says.

“The contractor will try to pass on the increase in their bids for new work and the dealer will try to pass on the increased cost in either the rental rate or the sales price,” Gregory adds. “In both cases, if they do not pass it on, their bottom line profitability will be impacted.”

Many economists, including the Wells Fargo Securities team, are projecting another interest rate increase this year, and potentially three additional rate increases next year.

If these increases occur, financing costs will increase, leaving all machine buyers with “difficult decisions regarding how they finance their business, inventory and rental fleets, and ultimately how to pay for these increased costs,” Gregory says.