Repairing aging water systems, design-build projects, and industrial and marine projects are three of the 10 fastest growing categories in government contracting, according to an analysis by government bid data provider Onvia.

Two other categories mentioned in what Onvia calls the “10 Hotspots in Government Contracting” will also have an indirect impact on contractors: traffic planning and Geographic Information System (GIS) services.

While seeing modest overall growth for what it calls the state, local and education (SLED) segment, Onvia views these construction-specific areas as rising to the top of the total $1.5 trillion U.S. governmental procurement market:

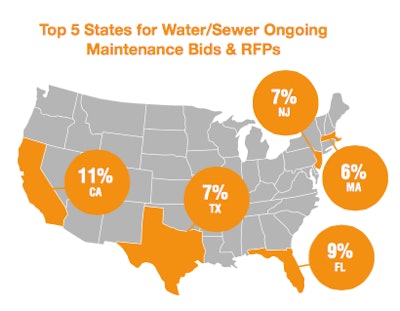

Hotspot No. 3: Addressing aging water systems.

And within the broader category, water supply, sewer and wastewater each grew at the same pace. Most contracts (55 percent) are at the city level. Onvia’s take away: Contractors who focus on water system repairs and maintenance should consider high value multi-year contracts with cities.

Hotspot No. 6: Shifting to design-build projects.

“The design-build trend lets agencies save time and money by consolidating the two major phases of big infrastructure projects into a single procurement,” Onvia says. “Industry observers have noted that these projects have been moving from alternative to mainstream status.”

Onvia’s database shows that the number of design-build projects rose 18 percent in 2015. Cities use this type of contracting the most (38 percent), followed by state agencies at 25 percent. Special districts had the largest average contract value at $55 million, followed by state government, at $26 million and cities, at $11 million. Onvia’s take away: Contractors that normally compete for traditional building projects should consider teaming with design related firms.

Hotspot No. 9: Increasing industrial and marine projects.

Warehouse and marine-related construction by the SLED segment is robust, with the number of projects rising 16 percent in 2015. The majority (56 percent) of projects involve harbors, docks and piers, while the remainder includes warehouses and smaller industrial structures.

Cities (37 percent) were the strongest procurer of these services, followed by state agencies at 27 percent. City projects average $2 million, while special port district jobs averaged $1.8 million. Onvia’s take away: Industrial and marine contractors should target city and port agencies to identify larger upcoming projects.

The two hotspots with an ancillary impact on construction include:

Hotspot No. 2: Doubling down on GIS.

A hotspot for two years in a row, providing GIS software and custom applications is a precursor to many construction projects. Government agencies have been expanding their use of open data, Internet of Things and smart city initiatives. Onvia says there’s no signs of slowing in the growth rate of GIS contracting: after posting a 20 percent growth in 2014, GIS projects grew by 24 percent in 2015.

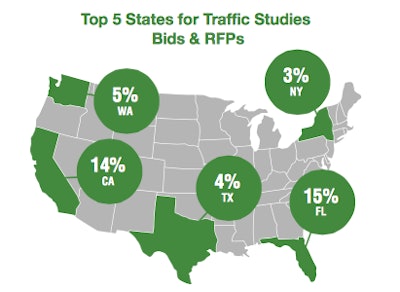

Hotspot No. 5: Planning for more traffic.

Traffic congestion is prompting many government agencies to turn to expanded transit options and intelligent solutions (such as smart intersections) to alleviate this problem. The number of traffic engineering studies commissioned by SLED agencies in Onvia’s database rose 19 percent in 2015.

Most contracts came from state (37 percent) and city (34 percent) governments. Onvia’s take away: Engineering firms specializing in traffic studies should consider leveraging available budgets, transportation and capital improvement plans to grow in this area.

To download the full report, click here.