Equipment and software investment is expected to grow 7.8 percent overall in 2021, according to the annual outlook released by the Equipment Leasing & Finance Foundation.

Although the update indicates the worse of the economic downturn appears to be in the rearview mirror it doesn’t mean that the road ahead is clear, says Scott Thacker, foundation chair and CEO of Ivory Consulting. “Prospects of widely-distributed vaccines in 2021 should provide a boost to the economy, particularly in transportation-focused industries.”

Released in conjunction with the economic outlook, the group’s Foundation-Keybridge U.S. Equipment & Software Investment Momentum Monitor tracks 12 equipment and software investment verticals.

For verticals of particular interest to equipment dealers, the monitor says that over the next three to six months construction machinery investment growth should rebound, agricultural machinery will accelerate, material handling will return to positive growth, trucks will rebound and mining and oilfield equipment will improve but remain in negative territory.

Here are the details:

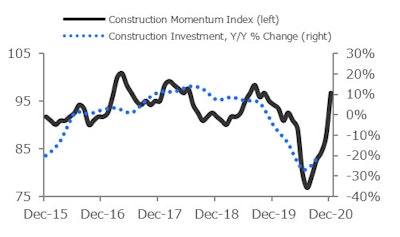

Construction

Investment in construction machinery expanded 31% (annualized) in Q3 2020 but is down 21% year-over-year. The Construction Momentum Index jumped from 87.6 (revised) in November to 96.7 in December. In October, shipments of construction equipment improved 3.5%. The index expects this segment’s investment growth to improve in the coming six months.

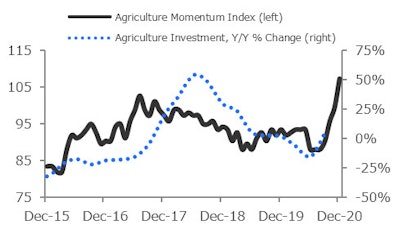

Agricultural

Investment in agricultural machinery surged 164% (annualized) in Q3 2020 and is up 6.0% from one year ago. The Agriculture Momentum Index jumped from 99.5 (revised) in November to 107.2 in December, the highest level since 2012. In November, the M1 Money Supply grew 8.4%, and the Dollar-Renminbi exchange rate increased 1.8%. The Index’s multi-year high suggests investment growth in agriculture machinery will accelerate in the coming one to two quarters.

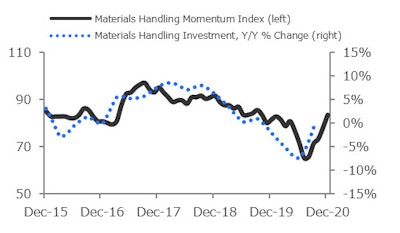

Materials handling

Investment in materials handling equipment grew at a 40% annualized rate in Q3 2020 but eased 0.8% year-over-year. The Materials Handling Momentum Index increased from 78.2 (revised) in November to 83.5 in December. In October, materials handling equipment inventories fell 1.7%, but shipments improved 1.0%. The index expects a return to positive growth in this sector over the next six months.

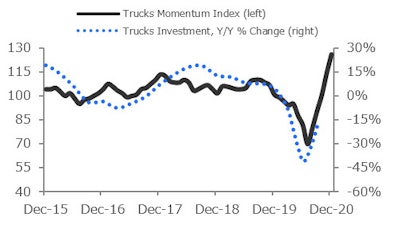

Trucks

Investment in trucks surged 296% (annualized) in Q3 2020 but was down 19% from year-ago levels. The Trucks Momentum Index jumped from 114.3 (revised) in November to 126.1 in December, the highest level in a decade. In October, earnings for freight trucking improved 2.1%, and the manufacturers’ inventories of light trucks and utility vehicles rose 6.1%. The index continues to point to a rebound in trucks investment growth over the next two quarters.

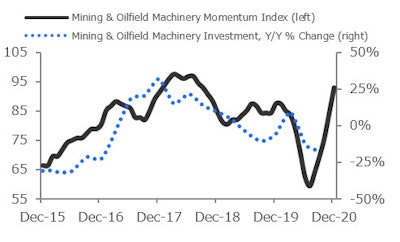

Mining and Oilfield

Investment in mining and oilfield machinery dropped 37% (annualized) in Q3 2020 and is down 18% compared to a year ago. The Mining & Oilfield Machinery Momentum Index rose from 84.4 (revised) in November to 93.0 in December. Natural gas distribution industrial production edged up 0.1% in October, but crude oil production grew 5.7% in November. The index expects potential improvement in mining and oilfield investment growth over the next six months, but growth may remain in negative territory.

The Foundation-Keybridge U.S. Equipment & Software Investment Momentum Monitor consists of indices for 12 equipment and software verticals . These indices identify key turning points in their respective investment cycles with a three to six month lead time. Equipment and software investment data comes from the Bureau of Economic Analysis (Nonresidential Private Fixed Investment, chained dollars) and is publicly available on BEA’s website on a quarterly basis. The underlying Momentum Monitor data comes from other publicly available sources, including BEA and the Census Bureau, and is used to calculate the Momentum Monitor indices.