Of particular note for dealers, Section 179 tax breaks apply to new, used and leased equipment. The caveat, and why there is usually a crunch in December, is that this is contingent upon the equipment being put into service by midnight Dec. 31.

Under the 2016 bill, equipment buyers can apply a 50 percent bonus depreciation on top of the Section 179 standard depreciation to any equipment bought during a fiscal year. The remainder can be depreciated across the useful life of the equipment.

Unfortunately, the bonus depreciation element does not apply to used equipment, so dealers should take care in explaining this detail. For new equipment, the rules have altered, with the 50 percent rate available through next year. It will drop down to 40 percent in 2018 and 30 percent in 2019.

So for new equipment sales, 2017 was, and 2018 remains to be, a target for maximizing bonus depreciation for customers.

Section 179, as part of the 2016 bill, also had its cap increased (and permanently extended) to $500,000 from the previous $25,000 level. Companies can deduct from their gross income the full purchase price of qualifying equipment bought during the year. Annual qualifying purchases of more than $2 million involve a dollar-for-dollar phase out of the depreciation until it is eliminated to $2.5 million. This means $2 million in equipment purchases allows for $500,000 to be deducted, but $2.3 million allows for $200,000 to be deducted.

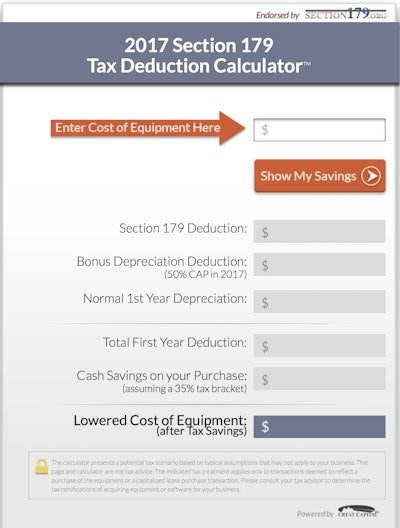

The calculator simply requires the cost of the equipment be entered, and then the program calculates the Section 179 deduction and the bonus deprecation to show the cash savings on the purchase. For example, a $200,000 purchase would provide a $200,000 Section 179 deduction, resulting in a $70,000 cash savings on the purchase, which provides a lower cost of equipment of $130,000.

While Section 179 may seem like a golden opportunity to for both dealer and contractor, dealers also should look at a customer’s unique situation closely to determine if now is the right time for a purchase. A contractor’s tax bracket status may dictate the best time for a purchase. A lower-tax-bracket business looking to grow in 2018, for example, might want to hold off dedicating all or a portion of Section 179 until next year.

![Caterpillar 320 e-fence[1581]](https://img.equipmentworld.com/files/base/randallreilly/all/image/2017/11/eqw.Caterpillar-320-e-fence1581.png?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)