[Editor’s Note: This is Part Four in a four-part series chronicling the stories of real contractors who are making hard choices about their end game in the business: liquidate? Sell to family or employees? Seek a third party buyer?]

Stever Robbins, executive coach with Stever Robbins Incorporated, says assuming you’ll pass your business along to your children carries risk.

“The biggest problem is that a lot of kids simply don’t want to go into the family business,” he says. “When the media focuses on 28-year-old tech millionaires, you don’t often hear about people doing the real work. If you count on your kids and then they’re not interested, you’re left with no options.”

Whatever the situation, it puts the contractor in the position of having to form an alternative exit strategy. The most viable options come down to a choice between selling to employees and selling to an outside party.

Long-term planning

Whatever the path the seller takes, the key is long-term early planning, says Gregory R. Caruso, Esq, CPA, CVA, a partner with Harvest Business Advisors in Columbia, Maryland.

Caruso’s firm performs business valuations, business brokerage and succession transaction consulting for contractors, subcontractors, suppliers and engineers.

Thinking you’re going to put your business up for sale today and then being on the golf course in a year or so will only work if your business is profitable today. Equally important, you’ll have difficulty selling a business that’s “all you.”

If a great deal of your business is kept in and run from your head, then you need to put systems in place that ensure what you’re selling will stay in place after the deal closes. Some contractors don’t realize until they’re ready to sell that they may not have a great deal of transferable value.

The current economy has also pushed exit plans aside as contractors attempt to boost profits and build their company’s value prior to selling, hoping to get the highest price possible.

Caruso says a number of his clients who are ready to retire are now looking at next year and two years after. “A lot of people in ’07 and ’08 thought they’d be out of the business by ’10 or ’11,” he says. “They’re still in.”

One problem company owners may have when they’re trying to sell is the tendency to overvalue their own business, Robbins says, and he recommends talking to a business broker who knows and understands how acquirers value businesses.

“However, don’t just follow their advice willy-nilly,” he says. “And if you can broker your own deal, that’s great, but if not, you should use an expert.”

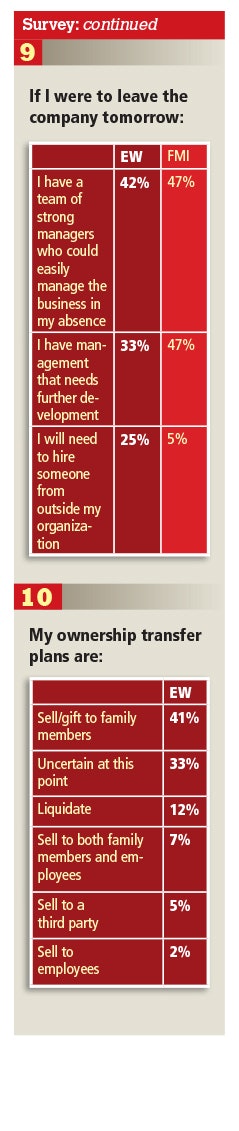

For contractors who are unable to or don’t wish to transfer ownership to a family member, selling the company to key managers is often a preferred course. In today’s economic climate, though, even longtime employees may not have the net worth needed to buy the company, and they often are unable to get the needed loans and bonds.

You only have a management buyout option, though, if you have the right personnel in place. You should have a manager on board five years before your planned exit date who is the right age, with the right attitude and net worth.

If your top guy is near your own age, he may not be interested in taking on your business.

Lifestyle company

If you’re a sole proprietor with no investors to consider, Robbins has an unorthodox approach that works for forward-thinking business owners—one he calls “Just Take It.”

This approach works best for those who love doing the work and do not like the hassle and overhead of running a big business.

Robbins cautions that this strategy is not for everyone. “It’s important not to put yourself in a situation where you take too much money out of the company, or you reduce your staff to the point that if you get sick, your income totally stops,” he says.

However, if you’re a small contractor, this strategy could give you the freedom to draw out the cash you need while allowing you to avoid developing a complex exit strategy. If you have partners, or your company has a complex structure, then you’ll need to have a strategy in place.

The key is planning, and planning early. Robbins says sometimes the way you form your business affects the exit strategy. “If your company is large with a certain type of structure, your options may be limited,” he says. “Looking at your options as early as possible doesn’t mean you have to take action immediately—it just may inform your decision-making process.”

For example, Robbins says if you’d like to have your company acquired by a larger firm, give thought to how you’ll be building a credible portfolio. Your company needs to be a suitable fit for the potential new owner. If your business performs the same scope of work as the company you’d like to be acquired by, you’ll be more attractive to them.

If your range of work differs, you must be able to make a convincing case for their company to expand. Do the research beforehand and find out what will make them want your company as a division of theirs.

Doing the research and looking at your business years before you’re ready to exit the industry will serve as an alignment for your firm—Caruso recommends knowing 10 years out when you’ll be interested in leaving.

If you want your managers to buy you out, sit down with them now to gauge their intentions, and come up with a long-term plan, say 10 percent per year over 10 years. Many contractors who do exit the industry sell their company over time. Harvest Business Advisors has seen success with selling small portions of a construction company over many years.

In return, the owner retains the right to sell the company if a cash buyer comes along. The employees agree to stay with the new owner for a specified period of time. This plan creates an employee buyout option and locks in the employees. Although you give some equity away, you create higher value for your company, which results in a higher profit.

This is a solution that could not happen without substantial planning, which is one of the most common mistakes Caruso says he sees. “Owners do nothing and think they are keeping their options open. The number of 70-year-old contractors who think it is a secret that they are going to sell or close shop in the next 10 years is astounding.”

If you begin to discuss your future plans at your annual meeting, everyone will be aware of your plans, and it won’t be as traumatic as a sudden announcement. You may even be able to position it as new opportunities for your employees.

“We recently sold an engineering firm where the key manager was a very good salesperson,” Caruso says. “He was excited to get to sell additional products and services that the bigger buyer had. His sales skills were also a huge contributor to the value of the seller, and it was a win-win based on frank, factual conversations.”

Another benefit of long-term planning is that it serves as an alignment, helping you understand the steps you must take. You’ll know what creates value. Not only will you know what will put your business in the best financial shape possible for a sale, you’ll avoid the long-term implications of any mistakes you might make without a planning process.

The Future of Your Company, a 4-part series

Page: 1 2 3 4 5