Caterpillar makes a big haul

Unit Rig mining trucks have ‘market compatibility’ with existing Cat product line

By Mike Anderson

When the Caterpillar acquisition of mining equipment giant Bucyrus was finalized in July, the resulting announcement of new Cat Mining models seemed the perfect fit – almost.

The 793F represents the fifth generation of the 240-ton-payload cornerstone to the Caterpillar mining truck family, started in 1984. Cat now adds the Unit Rig family, a pioneer brand that built the world’s first 200-ton electric-drive truck in 1969.

The 793F represents the fifth generation of the 240-ton-payload cornerstone to the Caterpillar mining truck family, started in 1984. Cat now adds the Unit Rig family, a pioneer brand that built the world’s first 200-ton electric-drive truck in 1969.There were several products Cat didn’t have, including surface drills, hydraulic and electric rope shovels, draglines, underground drills, scoops, face haulers and longwall shears. It wasn’t a hard decision to re-brand them Cat.

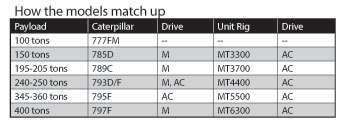

But what about the Bucyrus mining trucks, the former Unit Rig models previously owned by Terex? With its 10,000-plus large mining trucks in the worldwide market, Caterpillar already had market-leading models covering the payload range up to 400 tons.

Noting that 85 percent of Caterpillar large mining trucks ship to traditional markets in the Americas and Australia/Indonesia, Cat says there is “good market compatibility” with Unit Rig, since Unit Rig’s “rest of world” (excluding Africa) shipments are 41 percent of its total compared to Caterpillar’s 8 percent.

Unit Rig trucks will eventually shed their MTU or Cummins engines in favor of Caterpillar power plants. “With a decent product, and with Caterpillar-type product support, investment, distribution and development, we will really do some remarkable things with these Unit Rig trucks,” says McCord, who notes that the eight-month wait for the Bucyrus deal to be approved was miniscule compared to the time he and his colleagues had to figure out what to do with the mining trucks. “We’ve had eight years and 11 days to think about it,” he notes, “because on July 1, 2003, we announced we were acquiring Unit Rig, and we expected to complete the acquisition by the end of the year.”