The last time contractors were this optimistic, the economy tanked and went into the longest and deepest recession since the Great Depression. That was ten years ago.

Today’s optimism is reported in the recently released Wells Fargo Construction Industry Forecast 2015.

Of course this time, as economists like to say, it’s different. The last recession was sparked by a massive, mortgage based credit bubble. And this time, there aren’t enough houses being sold or mortgages being made to come anywhere near a bubble.

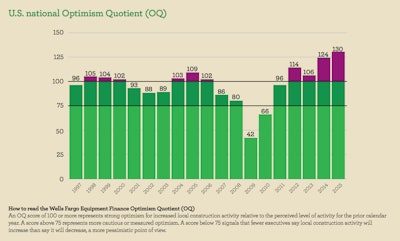

But otherwise, the economy, in terms of Wells Fargo’s “Optimism Quotient,” looks strong—historic, in fact, at 130. The next best score, 109, was reached in 2005. A score of 100 is generally considered good. Below 100 signals concerns.

It is interesting to note that contractor’s confidence began to creep downward after 2005, from 102 the following year to 86 and 80 in 2007 and 2008 when the recession officially began. From 2008 to 2009, contractor optimism plummeted from 80 to 42, an all-time low. This might lead one to believe that contractor sentiment is a leading indicator of the economy in general.

Some highlights (you can download the entire report here). When asked what factors create the greatest opportunity for growth in the construction industry today, contractors listed the following:

- 60 percent–improving national economic situation

- 48 percent–increased consumer confidence

- 38 percent–improving local economic situation

- 31 percent– stable regulatory environment

- 26 percent–the residential construction market

The report also found that 70 percent of the contractors said they would increase equipment acquisition in 2015, compared to just 34 percent in 2014. And this year 62 percent of contractor respondents said they expected to increase equipment rentals compared with just 37 percent last year.

The biggest concerns contractors listed include:

- 67 percent–political/regulatory environment

- 67 percent–national economic uncertainty

- 37 percent–local economic uncertainty

- 27 percent–rising interest rates

- 24 percent–Tier 4 emission standards

Of the political issues that dominate concerns 72 percent listed tax incentives such as the bonus depreciation deductions, 62 percent said the highway funding bill and 47 percent named the Affordable Care Act, aka Obamacare.

Unless the doomsayers like David Stockman turn out to be right, the economy looks to be on a winning streak for some time. Most of the major banks and economists have predicted growth rates for this year at anywhere from two to three percent or a little better.