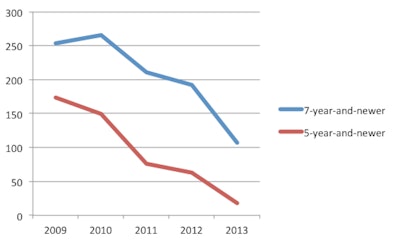

The decline in the number of used trenchers that are 5-years-old and newer are even more pronounced, than those of trenchers 7-years-old and newer, going from 174 units sold in 2009 to 18 units sold last year.

The decline in the number of used trenchers that are 5-years-old and newer are even more pronounced, than those of trenchers 7-years-old and newer, going from 174 units sold in 2009 to 18 units sold last year.The number of trenchers and cable plows being sold at auction has dropped significantly over the past five years, according to the TopBid auction price service.

Excluding wheel trenchers, the number of newer used trenchers and cable plows (7- years-old and newer) on the auction block went from 254 in 2009 to 107 last year. The numbers become even more pronounced in 5-years-old-and-newer trenchers, which went from 174 sold in 2009 to 18 sold last year.

And through the end of May, only seven of the 5-years-old–and-newer trenchers and cable plows were sold at auction; at that rate, about 17 of these machines would be sold at auction at year’s end.

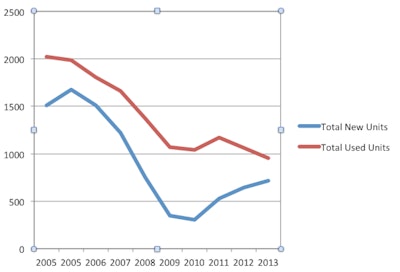

A look at financed new trencher data from Equipment Data Associates, which tracks the public Uniform Commercial Code-1 forms equipment lenders file after each transaction, offers part of the story.

New financed trencher sales in 2010 declined by 81 percent from their 2005 high of 1,678 units. And while new financed sales have risen steadily since 2011, financed used sales have been decreasing, from 1,168 units sold in 2011 to 953 last year. Taking a look at the May 1 to April 30 time period in the past two years, the number of financed used trenchers has decreased 5 percent.

But the industry’s dramatic sales dip in 2009-2010 only tells part of the story, say the two dominant players in trenchers, Ditch Witch and Vermeer. Throwing a wrench in auction sales of these machines is the fact that rental companies are using their own disposal avenues rather than going to auction.

“There’s been a huge amount of re-fleeting done by the top 10 national rental accounts, and they’ve taken a more direct approach of selling their used equipment versus taking it all at auction,” says Greg Wolfe, Ditch Witch eastern sales manager.

Trencher sales trends over the last 10 years.

Trencher sales trends over the last 10 years.Rental companies are also hanging on to their trenchers longer, adds Renee Martin, general manager of HDD Broker, a used equipment service owned by Vermeer. “Because of replacement costs, these machines are now coming to us at three and four years old, versus the previous year and half turnover,” she says. And because rental fleets have grown, it’s also much easier for contractors to find a rental trencher, which may affect their decision to buy used, whether at auctions or another source, Martin says.

Since trenchers are a mature machine, and first owners tend to hang on to their machines longer than some other equipment types, it may take some time for all the impacts of the 2009-2010 dip to be felt. Of the 75 trenchers currently for sale on HDD Broker’s site, 44 percent of them are older than 14 years. “It will be interesting to see how the sales downturn in 2009 and 10 will impact the used market,” Martin says.

And don’t forget the looming impact of Tier 4 on the market. “Tier 4 is not part of our customer’s dialogue right now, and we don’t see it having a significant impact for three to five years.” Martin says. “The caveat, though, is that climate concerns are getting a lot of media attention and that may trickle down.”

Martin also has her eye on the impact on export sales. “Thirty percent of our trenchers are exported, with buyers in South Africa and Russia the two largest segments right now ,” she says. Since neither of those countries have an ultra low sulfur fuel infrastructure in place, and Tier 4 equipment chokes on higher amounts of sulfur in fuel, “it will be interesting to see what changes the global market makes,” she says.

While trenchers are sold in comparatively small numbers compared to other equipment types – 714 new financed trenchers of all sizes were sold in 2013 compared to 15,349 new financed skid steers, for instance – it will be interesting to see if what’s happening in the trencher world will have wider implications throughout the equipment industry.